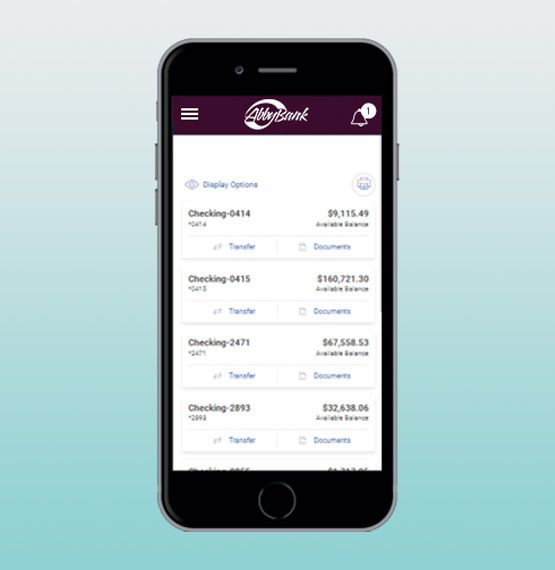

AbbyBank

Hi, we’re AbbyBank. We are so happy you’re here!

Customer Testimonial

"When we were looking for a bank for our business, we wanted more than a bank. We wanted a partner to help us navigate through opening our business and growing it; a banking partner that we could not only use for everyday banking but also get a business credit card and credit card processing. I called and spoke with Tracy [Engman]. I knew after one conversation with her that this was going to be our banking partner for our business. She was so extremely helpful through every step of the way in getting all our services set up. We feel like we were banking with a friend, not just a bank account.

Also setting up our corporate credit card was extremely easy to apply for and it came in the mail very quickly. This helped us [with] getting all our vendor accounts set up right away.

We could not be happier with our decision to bank with AbbyBank. We have definitely found a banking partner for life! Not only for our business banking, but due to the amazing service, now our personal banking as well!"

Need help deciding? We got you!

Proudly supporting farmers since 1968.

Drive your business forward.

We're committed to your success. Team up with a Commercial Loan Officer to discover what AbbyBank can do for you.

We’d love to talk to you.

If you have any questions regarding banking with AbbyBank, we will be happy to help you out.

Call us at 1 800-288-2229 or at any of our locations.

Abbotsford - 715-223-2345

Appleton - 920-993-1234

Gresham - 715-787-3201

Medford - 715-748-5333

Shawano - 715-526-2265

Wausau - 715-848-1610

Weston - 715-241-6336

Withee - 715-229-3500

Customer Support Hours

Monday - Thursday: 8 am - 5 pm

Friday - 8 am - 5:30 pm

We'd make a great team.

Thank you for choosing AbbyBank.

President & CEO