Community Reinvestment Act

At AbbyBank, we aim to make a positive impact on our local communities. We are dedicated to addressing the financial needs of these communities, including low and moderate-income as well as minority areas within our footprint.

In adherence to the Community Reinvestment Act (CRA) rules and regulations, our Public File information can be found below. The content is updated annually as of April 1 and may be updated periodically. Feel free to reach out to us if you have any questions.

CRA Performance Evaluation

A copy of AbbyBank's most recent CRA performance evaluation can be found below.

(897.5 KB PDF)

HMDA Disclosures (80.1 KB PDF)

Loan to Deposit Ratio* (81.4 KB PDF)

Rating Status

2024 - Satisfactory

AbbyBank Assessment Areas

The assessment areas for AbbyBank are outlined below according to branch locations. Each area includes detailed information specific to that branch.

Open or Closed Branches for current year.

(9.3 KB PDF)

Assessment Area Census Tracts

(980.6 KB PDF)

Written Comments

CRA eligible complaints, and responses are provided as of April 1 of the current year and for the prior two years.

News Articles & Letters

(3.9 MB PDF)

(3.9 MB PDF)

Public Comments

(184.8 KB PDF)

(184.8 KB PDF)

Products & Services

Below, you'll find links to AbbyBank's products and services. Click on each link to access individual offerings for both personal and business needs.

Personal Products

Personal Services

Business Services

Fee Schedule

Personal Deposits

(45 KB PDF)

(45 KB PDF)

Business Deposits

(127.3 KB PDF)

(127.3 KB PDF)

Impact Report

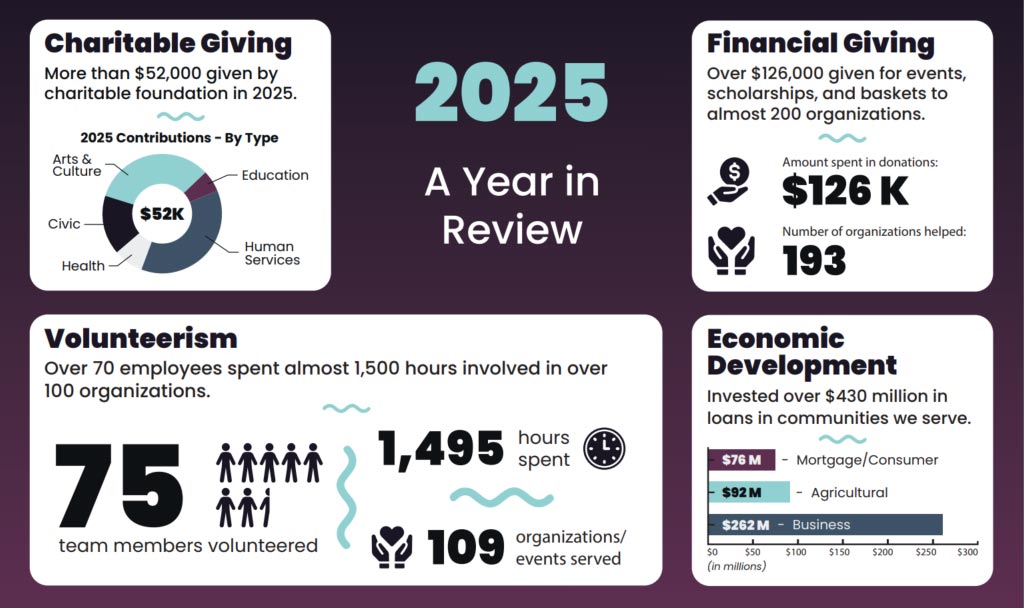

In our commitment as a community bank, AbbyBank continually seeks avenues to contribute to the well-being and success of our customers, communities, and employees. Explore the impact we made in 2025.

Common Questions

What is the Community Reinvestment Act (CRA)?

The Community Reinvestment Act (CRA) is a federal law enacted to encourage financial institutions, like AbbyBank, to meet the credit needs of the communities in which they operate, particularly low and moderate-income areas.

Can I access information about AbbyBank's CRA activities?

Absolutely. AbbyBank makes information about its CRA activities readily available through a Public File, as required by CRA rules and regulations. You can find detailed information on our assessment areas, lending activities, and community development initiatives. You can request a hard copy or view the information on this website page.

How often is AbbyBank's CRA Public File updated?

AbbyBank updates its CRA Public File annually, with the information being current as of April 1 each year. This ensures that stakeholders and the public have access to the latest details about our CRA activities. Some items are updated quarterly as needed.

How does AbbyBank fulfill its CRA obligations?

AbbyBank is committed to meeting its CRA obligations by providing a range of financial services and investments that benefit the local communities we serve. This includes supporting affordable housing, small business development, and community development projects.

What is included in AbbyBank's CRA Public File?

AbbyBank's CRA Public File includes comprehensive information on our assessment areas, lending performance, and community development efforts. It provides transparency into how we contribute to the economic well-being of the communities we serve.

Can I contact AbbyBank for more information about CRA?

Certainly. If you have any questions or need further clarification about AbbyBank's Community Reinvestment Act activities, feel free to reach out to our dedicated team. We're here to provide the information you need.

*Source - UBPR

Please visit your local AbbyBank location for questions or to receive a hard copy of the banks CRA Public File.